Investment expenditures are the expenditures made on capital goods which are used for the production of consumer goods. The level of investment is influenced by interest rate which is the cost of borrowing and reward for saving and the process of influence can be seen from the marginal efficiency of investment (MEI), which is the investment schedule. As seen in the MEI, it depicts the relationship of interest rate and the rate of return on investment which will determine the level of investment.

Investment decision is based on the notion of profitability which is influenced by the interest rate and the rate of return on investment as depicted in the MEI. The rate of return of investment is inversely related to the level of investment as it is subjected to the law of diminishing return whereby the rate of return on investment will diminish as the level of investment increase. In an investment decision, the investor will increase the level of investment when the rate of return on investment is greater than the interest rate and reduce the level of investment when the rate of return on investment is less than the interest rate. Thus, the equilibrium level of investment is attained when the rate of return on investment is equal to the level of interest rate.

Based on this notion of profitability, it can be noted that a decrease in the level of interest rate will lead to a rise in the level of investment while a rise in the level of interest rate will cause a fall in the level of investment.

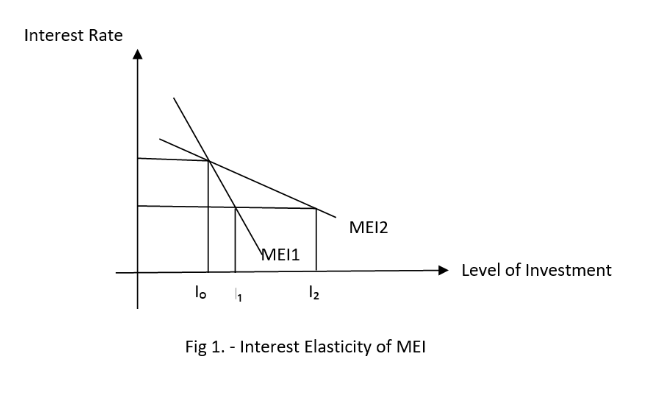

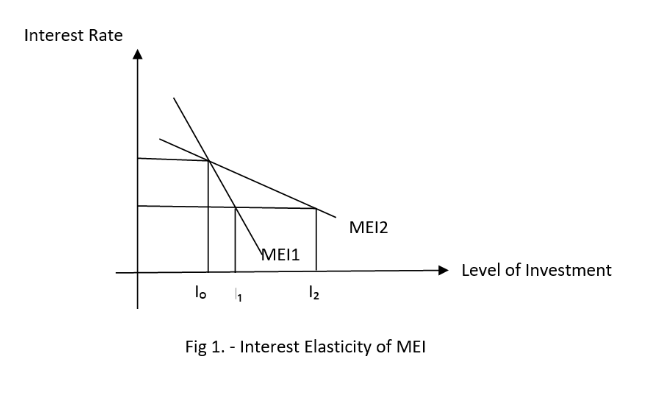

As seen from the diagram, the level of investment at lo whereby the rate of return at R0 is equal to the level of interest rate at ro. However, when interest rate is raised to r1, the level of investment will fall to I1 as it is no longer profitable if the level of investment remains at lo since the rate of return on investment at R0 is lower than the interest rate at r1 for the level of investment at l0. On the other hand, when the level of interest rate is lowered to r2, the level of investment will raise to I2 as it is still profitable to increase the level of investment since the rate of return on investment at R0 is greater than the interest rate at r2 for the level of investment at l0. Consequently, an inverse relationship can be seen whereby an increase in the interest rate will lead to a fall in the level of investment while a rise in the interest rate will cause a fall in the level of investment.

However, the extent of influence of interest rate on the level of investment will depend on the interest-elasticity of MEI as seen from the diagram, the influence of interest rate on the level of investment is extensive when the MEI is interest elastic whereby the fall in interest rate will lead to a more than proportionate increase in the level of investment. On the other hand, the influence of interest on the level of investment is less extensive when the MEI is interest-inelastic whereby a fall in the interest rate will lead to a less than proportionate increase in the level of investment. Under such circumstances, the level of investment will be affected by the level of technological development, market demand, political stability, business expectation and government policies.

In the case of Singapore, the MEI is interest inelastic as it is dominated by FDI. Foreign investors are likely to increase the level of investment as the business optimism is influenced by factors such as the tax policies of the government. If tax incentive is provided, FDI is likely to increase. Political stability will also raise investors' confidence as political stability ensure the return on capital and the expansion of the market demand which will provide higher level of rate of return on investment.

In conclusion, it can be seen that interest rate does influence the level of investment but it is not the only determinant of investment. Other determinants of investment are equally important. The extent of influence of the interest rate on the level of investment depends on the nature of the economy.