The average price of tickets for two concerts performed by singer-song writer Ed Sheeran in November 2017 at the Singapore Indoor Stadium was S$180. Tickets went on sale six months earlier and both concerts sold out almost immediately. Some tickets were later being offered for resale at prices well above their face value.

(a) Using supply and demand curves, explain why there is an excess demand for tickets and why there is a high resale price. [10]

Introduction

To understand why there will be an excess demand in this concert event and why the price will be higher when there is a resale market, there is a need to use the demand and supply analysis to derive market equilibrium which explains how the price and output is set based on the intersection of the demand and supply curve.

Main Body

1. Explain how the market equilibrium is set in the concert market without the resales marketIn the concert market, the supply curve is a fixed supply where the supply curve is vertically sloped, as the number of seats is fixed by the capacity of seating capacity set by the organizer. There is no change in the quantity supplied when the price of tickets increases or decreases. As for the demand curve, it is horizontally sloped or perfectly elastic as there is perfect market information about the price of ticket, implying that the consumers will not buy if the price is above the price set by the organiser and the concert seller will not sell if the price is below the price set by the organiser. Given these conditions, the market equilibrium is determined at the level of price and output where the demand curve intersect the supply curve where there is no excess demand or supply condition.

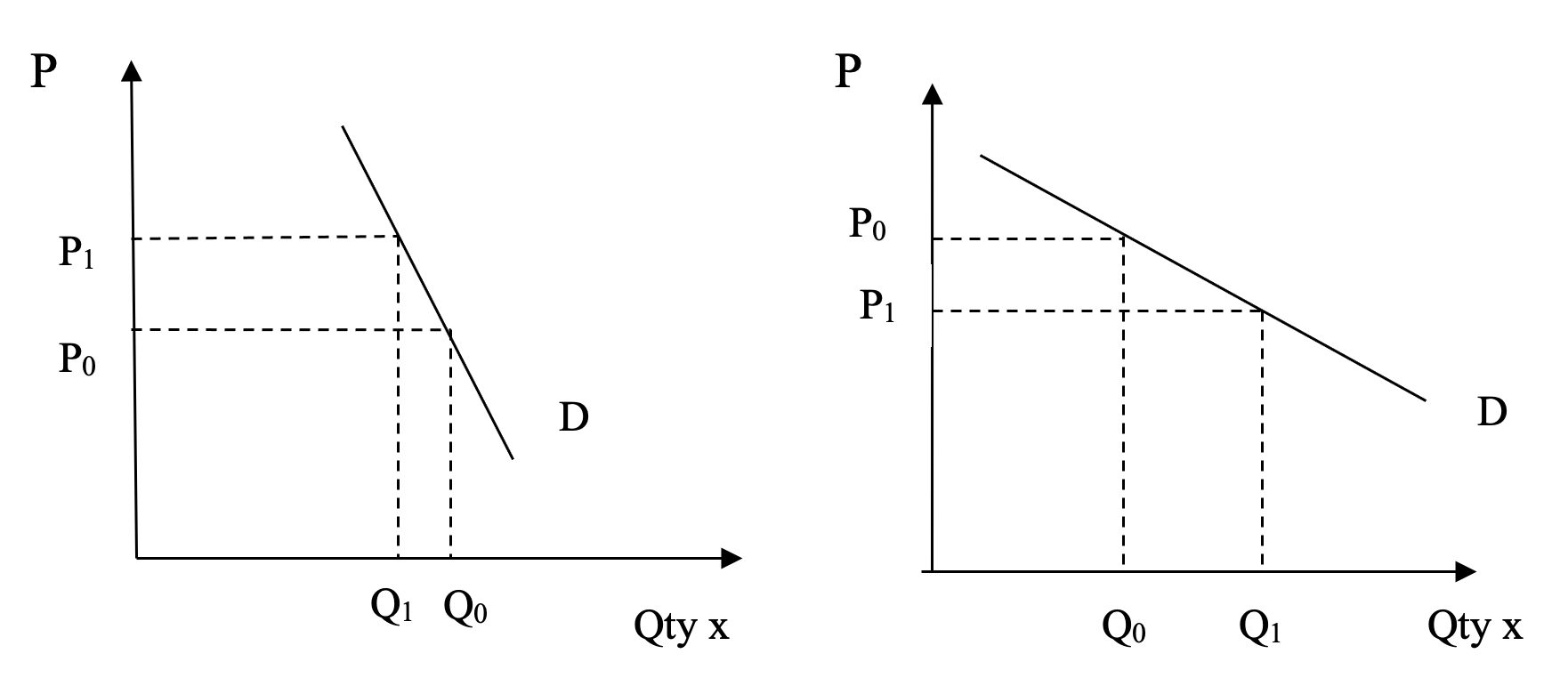

Diagram 1 - Market Equilibrium

As seen from the diagram, the demand curve is horizontally sloped as represented by Do while the supply curve is vertically sloped as represented by So which intersects at the market equilibrium at Eo. Consequently, the price and quantity level is set at Po and Qo.

2. Explain why there is excess demand and the price of concert ticket will rise when there is resale marketHowever, when there is a resale market demand, the demand curve changes from the perfectly elastic demand curve Do to D1 which is downward-sloping, reflecting the law of demand where there is an inverse relationship between the price and quantity demanded. The downward-sloping curve also reflects the taste and preference and the purchasing as the demand curve is determined by the income and substitution effects of the change in quantity demanded in relation to change in the price.

As a result of the change in the demand curve, it give rise to an excess demand condition at the price set by the organiser at Po as the level of quantity demand for the concert ticket is greater than the quantity supplied of the concert ticket. As this excess demand condition creates an upward pressure for the price to rise, the price level rises from Po to P1, contribution the higher price level whet her is resale market.

As seen the diagram 1, the demand curve D1 cuts the supply curve S1, creating an excess demand at the original price level and thus determines the market equilibrium at E1. This creates an upward pressure for price to rise and set the price level at another higher price level at P1 while the quantity level is at Qo.

3. Analysis – why price rises sharply?It is also interesting to observe that the price increases but its extent of increase in price depends on two factors, namely the price elasticity of demand and the extent of increase in demand for the concert ticket. For the price elasticity of demand, the degree of necessity of demand is reflected by the degree of interest towards the singer while the extent of increase in demand is influenced by the income, taste and preference and the substitutes. The price will rise extensively if the demand is price inelastic and the demand increases extensively, contributing to the extensive outward and downward-sloping demand curve.

Conclusion

In sum, the condition of excess demand and high price when the resale market is allowed can be explained by the demand and supply analysis and the knowledge of price elasticity of demand. However, the condition can only occur if the resale market is feasible and possible.

(b) Discuss possible strategies that concert organisers could use to improve the market outcome for this type of concert for producers and consumers. [15]

Introduction

Based on the demand and supply analysis and other economic concept like price strategy based on price elasticity of demand, it is possible to derive the best market outcome for the consumers and concert organizer (producer) with the types of concerts.

Main Body

1. Explain why the firm must decrease or increase to derive the best outcome which is to raise the total revenue.To ensure that the concert owner can raise the total revenue for the concert organizer, the concert owner can either raise or decrease price. In doing, it will depend on the price elasticity of demand for the concert ticket. In the situation when the demand is price elastic, it would appropriate for the organizer to lower the price, given that the decrease in price will lead to a more than proportional increase which increases the total revenue. On the other hand, the concert organizer will raise the price of the concert and this leads a reduction in quantity demanded by a less than proportional reduction in quantity demanded which will raise total revenue. The organiser can either raise the price to the level which is at market equilibrium when the demand is based on the resale market with a fixed quantity of supply or lower the price when the demand curve is based on the resale market and the organizer is able to increase production to Q1 to satisfy the resale market demand at Q1.

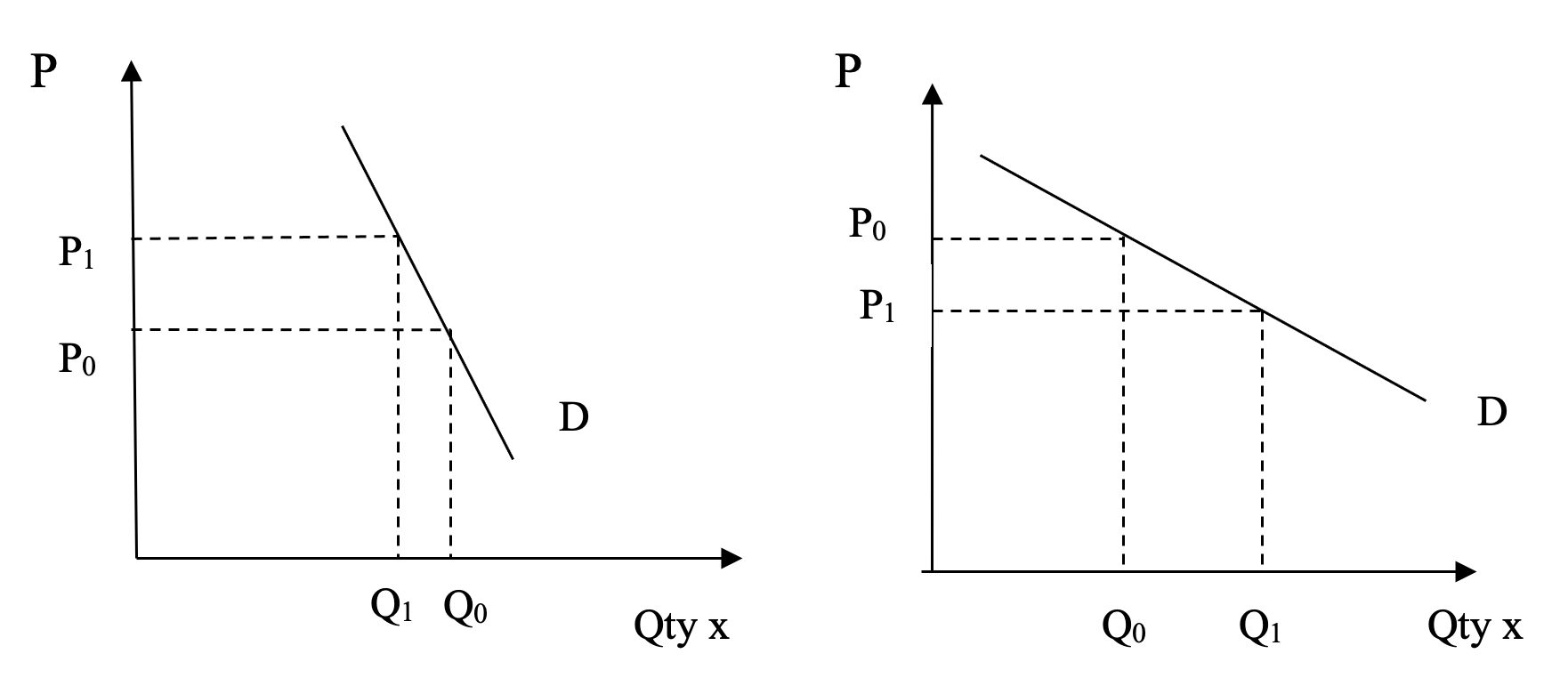

As seen from the diagram 1, an increase in price from Po to P1 for the concert ticket will cause a less than proportional decrease in quantity demanded for the concert ticket from Qo to Q1, contributing an increase in total revenue as the gain in revenue due to the increase in price is greater than loss in revenue due the reduction in quantity demanded, given that the demand is price-inelastic.

As seen from the diagram 2, a decrease in price of the concert ticket from Po to P1 will cause a more than proportional increase in quantity demanded of the concert ticket from Qo to Q1, contributing an increase in total revenue as the gain in revenue due to the increase in quantity demanded is greater than loss in revenue due the decrease in price, given that the demand is price-elastic.

2. Explain the best market outcome for the consumers when the market is based on the resale market demandAs for the best market outcome for the consumers, it would be get the extra concert ticket at the official price set at Po and allowed consumers to buy more tickets. This is possible if the market demand is price elastic and the concert organizer can lower the price to increase the total revenue. At the lower price, the concert organize must be able to raise the supply to a higher level at Qo so as to raise total revenue which depends on how the producer overcome the fixed capacity of the stadium.

3. Analysis – key determinantsBased on the above explanation, it can be observed that the improved outcome for the consumers and producers will depend on the price elasticity of demand which is influenced by the consumers’ degree of necessity of demand whereby the popularity of the singer will affect this determinant of PED. Consumers can only gain if the price is lowered and the quantity supplied is raised and this will also increase the outcome for the organizer. As for the condition of price inelastic demand condition, the producer will gain but the consumers do not gain as the price is higher based on the original quantity supplied. Thus, the best outcome for the consumers and producers is greatly affected by the price elasticity

Conclusion

In sum, the above economics principle can explain how the price strategies can be used to derive the best outcome for the consumers and organisers but this can only be understood with the limitations of the economics principles.